Your loan officer will receive a report, including a notice of valuation, from the appraiser.

The appraiser will assess the home’s value and check the home’s condition to make sure it meets the VA’s Minimum Property Requirements (MPRs).Your loan officer will order the VA appraisal and schedule the appraiser’s visit to the property.The VA appraisal process begins when you’ve found the right home, entered a purchase contract with the seller, and applied for a mortgage with a VA-authorized lender.

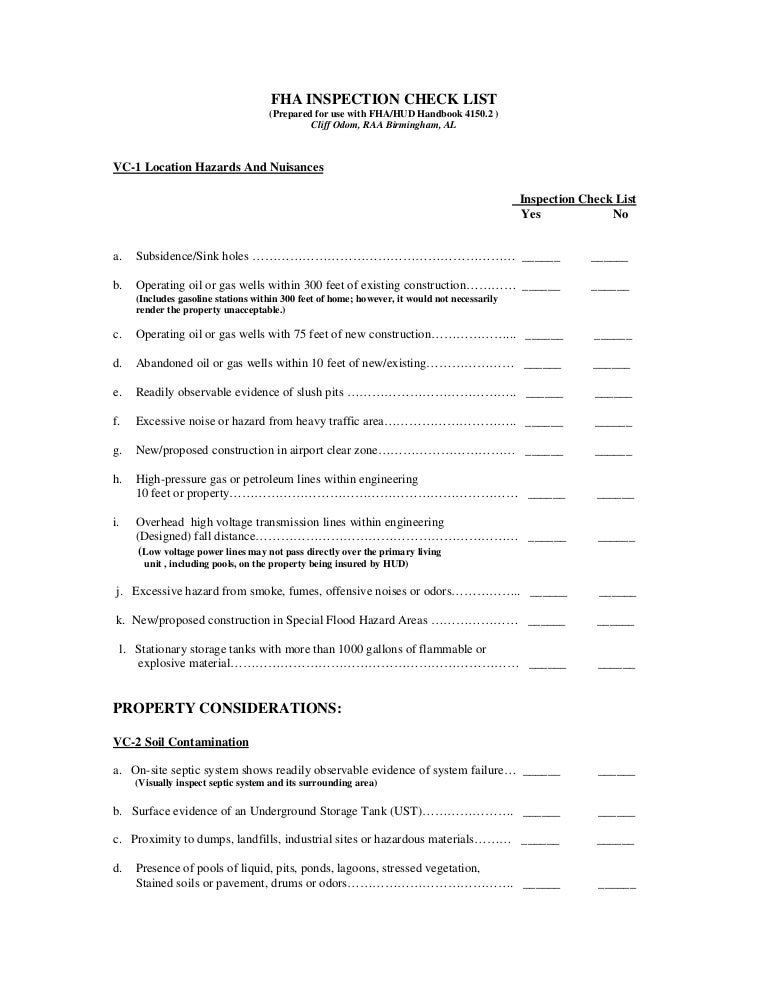

#FHA HOME INSPECTION CHECKLIST FREE#

Have an appraised value that meets or exceeds the loan amountīefore closing your loan, the lender will order a VA appraisal to make sure the home you’re buying meets these requirements.Ĭheck your eligibility for a VA home loan.Meet the VA’s Minimum Property Requirements (MPRs).To qualify for the VA loan program, a home must: It’s true: the Department of Veterans Affairs won’t back a loan for just any home. But did you know the home you’re buying has to qualify, too? To buy a home with a VA loan, you’ll have to qualify as a borrower. VA Appraisal & Inspection Requirements 2023

0 kommentar(er)

0 kommentar(er)